Your peace of mind

As professional estate agents, we take great pride in our work and do everything to the very highest standards. We are members of a number of industry bodies and associations, and abide by the regulations, rules and guidelines they publish.

This means peace of mind for you, knowing that we are detailed, stringent and honest in everything we do.

National Association of Estate Agents (NAEA)

NAEA Propertymark agents demonstrate transparency and ensure they are at the forefront of developments in the industry. Agents earn their membership of the Association through formal qualification, to ensure they have the required knowledge to guide you through your property transaction. Operating under strict rules of conduct, members must meet specific standards relating to professional and ethical practice.

The Property Ombudsman

The Property Ombudsman Scheme is an impartial scheme that resolves disputes between consumers and agents when the in-house complaints procedure has no resolution. It is approved and authorised by the Ministry of Housing, Communities and Local Government; the National Trading Standards Estate and Letting Agency Team; the Chartered Trading Standards Institute and the Ombudsman Association.

Association of Residential Lettings Agents (ARLA)

There is currently no mandatory regulation of lettings agents which means anyone can run a lettings agency. However, by using an ARLA Propertymark agent you are guaranteed protection and peace of mind when you are trying to find a new home or looking to rent out your own property. ARLA Propertymark agents are regulated to ensure they work to a higher standard than the law requires, operating in a transparent manner and providing services which are inspected independently.

Tenancy Deposit Scheme (TDS)

The TDS is a government-approved tenancy deposit protection scheme in England and Wales operated by The Dispute Service Ltd. Established in 2003, TDS is the longest serving government-approved deposit protection scheme.

The Housing Act 2004 requires landlords and letting agents to protect deposits on assured shorthold tenancies. The TDS provides both insurance-backed and custodial tenancy deposit protection with free, impartial dispute resolution for when disagreements arise over how the money is divided.

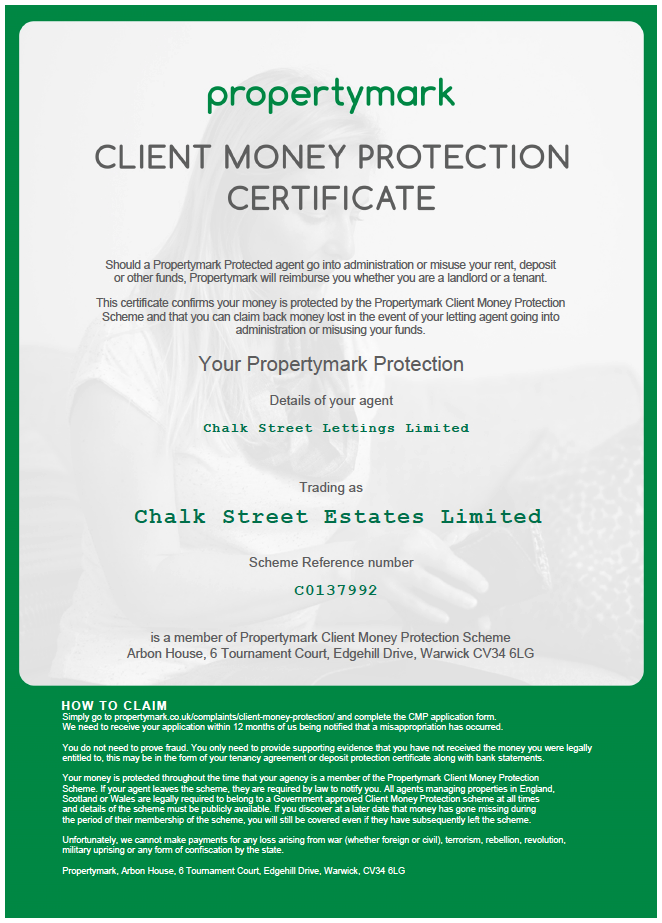

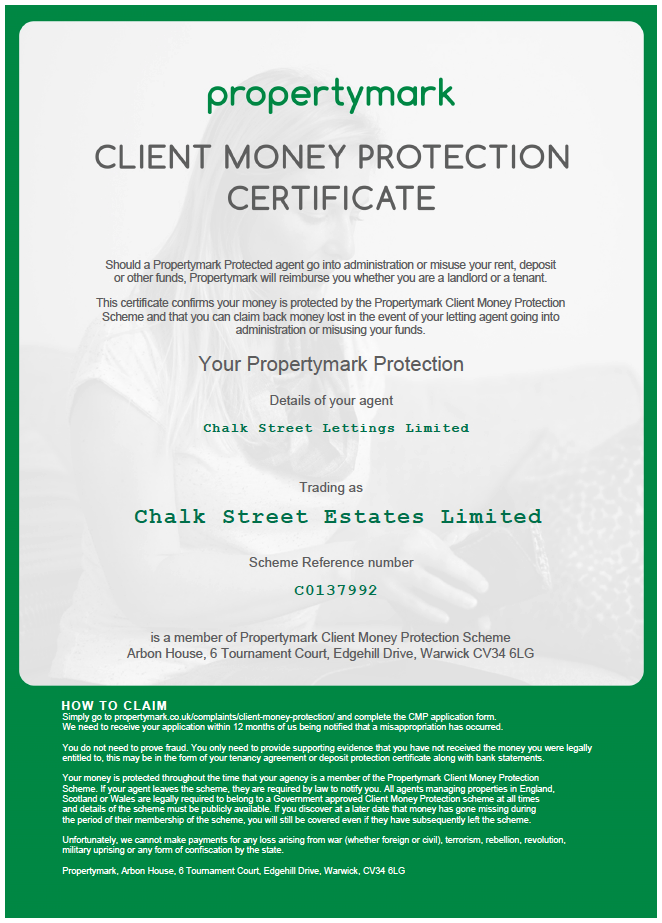

Client Money Protection Scheme

Membership of a government approved Client Money Protection Scheme is required for all letting agents in England who handle client money. This is a legal requirement which came into force on 1 April 2019, and enforcement is through local trading standards. We are members of Propertymark Client Money Protection and our current membership certificate can be viewed opposite.

Client Money Account

As of April 2021, it became a legal requirement for all letting and property management agents to hold a segregated, ring-fenced client account with their bank, specifically for holding the deposits or rent payments before the funds are transferred to their client. A client account therefore sits separate from the agent’s regular business bank accounts.

PayProp

At Chalk Street we manage lettings payments through PayProp, an automated rental payments platform. This cutting-edge software allows users to collect and reconcile rents, process payments to landlords, and generate invoices, receipts and statements in just a few clicks.

In short, PayProp:

- Pays out rent to landlords faster and more securely

- Gives real-time visibility of your property portfolio from a mobile app

- Protects your investments with multi-layered security

Information Commissioner’s Office (ICO)

The ICO exists to uphold information rights in the public interest, promoting openness by public bodies and data privacy for individuals.

ICO is an executive non-departmental public body, sponsored by the Department for Science, Innovation and Technology. Under the Data Protection Act 2018 organisations processing personal information are required to pay a data protection fee unless they are exempt. It is the law to pay the fee if you hold personal information for business purposes on any electronic device. We are aware of our data protection obligations and take this very seriously.

National Association of Estate Agents (NAEA)

NAEA Propertymark agents demonstrate transparency and ensure they are at the forefront of developments in the industry. Agents earn their membership of the Association through formal qualification, to ensure they have the required knowledge to guide you through your property transaction. Operating under strict rules of conduct, members must meet specific standards relating to professional and ethical practice.

The Property Ombudsman

The Property Ombudsman Scheme is an impartial scheme that resolves disputes between consumers and agents when the in-house complaints procedure has no resolution. It is approved and authorised by the Ministry of Housing, Communities and Local Government; the National Trading Standards Estate and Letting Agency Team; the Chartered Trading Standards Institute and the Ombudsman Association.

Association of Residential Lettings Agents (ARLA)

There is currently no mandatory regulation of lettings agents which means anyone can run a lettings agency. However, by using an ARLA Propertymark agent you are guaranteed protection and peace of mind when you are trying to find a new home or looking to rent out your own property. ARLA Propertymark agents are regulated to ensure they work to a higher standard than the law requires, operating in a transparent manner and providing services which are inspected independently.

Tenancy Deposit Scheme (TDS)

The TDS is a government-approved tenancy deposit protection scheme in England and Wales operated by The Dispute Service Ltd. Established in 2003, TDS is the longest serving government-approved deposit protection scheme.

The Housing Act 2004 requires landlords and letting agents to protect deposits on assured shorthold tenancies. The TDS provides both insurance-backed and custodial tenancy deposit protection with free, impartial dispute resolution for when disagreements arise over how the money is divided.

Client Money Protection Scheme

Membership of a government approved Client Money Protection Scheme is required for all letting agents in England who handle client money. This is a legal requirement which came into force on 1 April 2019, and enforcement is through local trading standards. We are members of Propertymark Client Money Protection and our current membership certificate can be viewed opposite.

Client Money Account

As of April 2021, it became a legal requirement for all letting and property management agents to hold a segregated, ring-fenced client account with their bank, specifically for holding the deposits or rent payments before the funds are transferred to their client. A client account therefore sits separate from the agent’s regular business bank accounts.

PayProp

At Chalk Street we manage lettings payments through PayProp, an automated rental payments platform. This cutting-edge software allows users to collect and reconcile rents, process payments to landlords, and generate invoices, receipts and statements in just a few clicks.

In short, PayProp:

- Pays out rent to landlords faster and more securely

- Gives real-time visibility of your property portfolio from a mobile app

- Protects your investments with multi-layered security

Information Commissioner’s Office (ICO)

The ICO exists to uphold information rights in the public interest, promoting openness by public bodies and data privacy for individuals.

ICO is an executive non-departmental public body, sponsored by the Department for Science, Innovation and Technology. Under the Data Protection Act 2018 organisations processing personal information are required to pay a data protection fee unless they are exempt. It is the law to pay the fee if you hold personal information for business purposes on any electronic device. We are aware of our data protection obligations and take this very seriously.